There are different types of cross-border payments. However, the principal differences between them are the transaction size and the parties involved. The size of the international payments market is growing at a rate of 5% a year, with a transaction breakdown below:

- Business-to-Business (B2B) transactions make up the largest share by far, expected to account for US$ 150trillion.

- Consumer-to-Business (C2B) transactions, such as cross border eCommerce and offline tourism spend, are forecast to reach US$ 2.8trillion.

- Business-to-Consumer (B2C) transactions, which include wage salaries or interest payments, are expected to amount to US$ 1.6trillion in 2022.

- Consumer-to-Consumer (C2C), or remittance payments, contribute the least – expected to reach US$ 0.8trillion in 2022.

International transfers can be categorized into two key sections:

Wholesale cross border payments

Wholesale payments: Used to settle transactions between banks and financial markets. Wholesale payments are small in number, but are typically very high in value, and represent most of the value of payments.

Wholesale payments support the interbank markets, so the safe and efficient operation of capital markets depends on these systems functioning smoothly, correctly and without fail.

Retail Payments: Transactions made between consumers and businesses. Retail payments account for almost all payments by number, but represent a small part of the total face value of payments.

The principal differences between these payment systems are the transaction size and the parties involved.

Recommended: Easy Dollar Card; your best choice for all international transactions

The rise of money transfer giant Changera

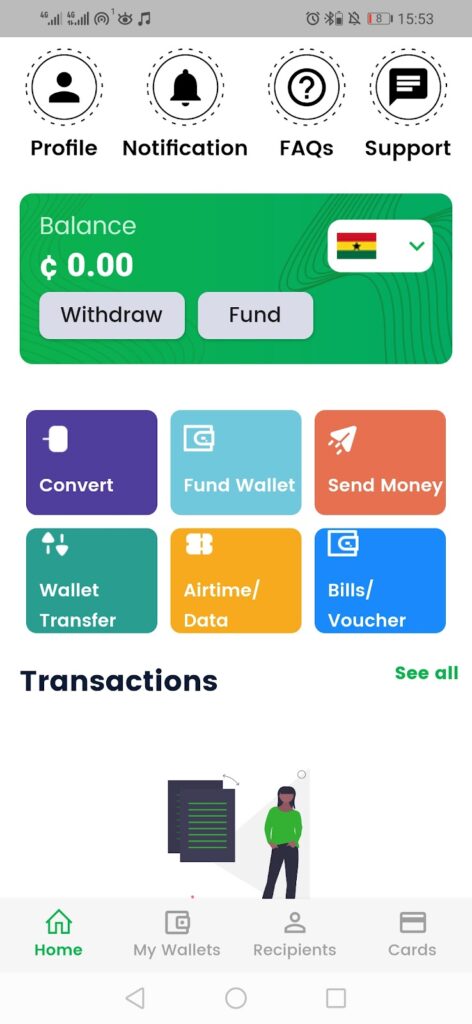

Changera is a Blockchain enabled platform which offers you digital cross-border payments solution without a third-party interference.

Blockchain allows Changera to bypass these traditional payment routes by offering a secure way to transact internationally. It also decreases the risk of fraud.

With Changera, high fees, delayed transactions and lack of transparency is a thing of the past. You also don’t get to experience any transaction limit as you can spend up to $10,000 monthly.

Be a part of the major change happening in Africa’s cross border payment system by downloading Changera app on iOS or Android.

Discussion about this post