You’re probably wondering whether it is even possible to send money across African countries. The good news is yes, you can. But you’ll have to find ways that are safe to do it. Sure, you can send cash via physical mail with a post service. But that is very risky. You need to use proven and safe digital ways to send money, which is an international money transfer app that can help with the remittance services.

Online banking via an app on your phone may be the norm, but when it comes to sending money between two people across borders, third party money transfer apps really excel.

Whether you’re looking to send money or transfer money for an international payment within African countries, money transfer apps have the ability to send your money across the world for a low fee and often in a matter of minutes, making the once expensive and stressful process of international payments now very seamless.

What is a money transfer app?

Money transfer apps allow individuals to transfer money to other people, friends and family, and businesses all over the world quickly, conveniently and securely. This kind of app simplifies payments and also allows you to use a digital wallet to link your credit card or bank account. You can make electronic transactions and payments with just a few taps on a mobile device.

A money transfer app is a downloadable application that tends to be free, and designed for use on smartphones and apps can be downloaded for both iOS and Android.

How to choose best money transfer app

The money transfer app space is growing constantly, and it can be hard to find the right app for your needs. Which is why in this guide, you will learn how to choose those apps to send money based on your specific needs including what you are using the app for, where you are sending money and the amount you are transferring. Some points to keep in mind include:

- Location

- Transfer cost, and

- Transfer speed

If you need to transfer money from one bank to another and would rather avoid the higher fees and longer transfer times often associated with using your bank directly, your best option is to use a money transfer app service.

These services will typically cater to either domestic transfers (within the country) or international transfers for people looking to send money overseas.

There are numerous international money transfer companies that have launched their services to offer cheaper, faster, and more efficient overseas transfers than ever.

Indeed, international money transfer apps are often a far more cost-effective way of sending money abroad than a traditional financial institution.

One of the best money transfer apps in Africa is Changera app, which has many features you need for international money transfer and bills payment.

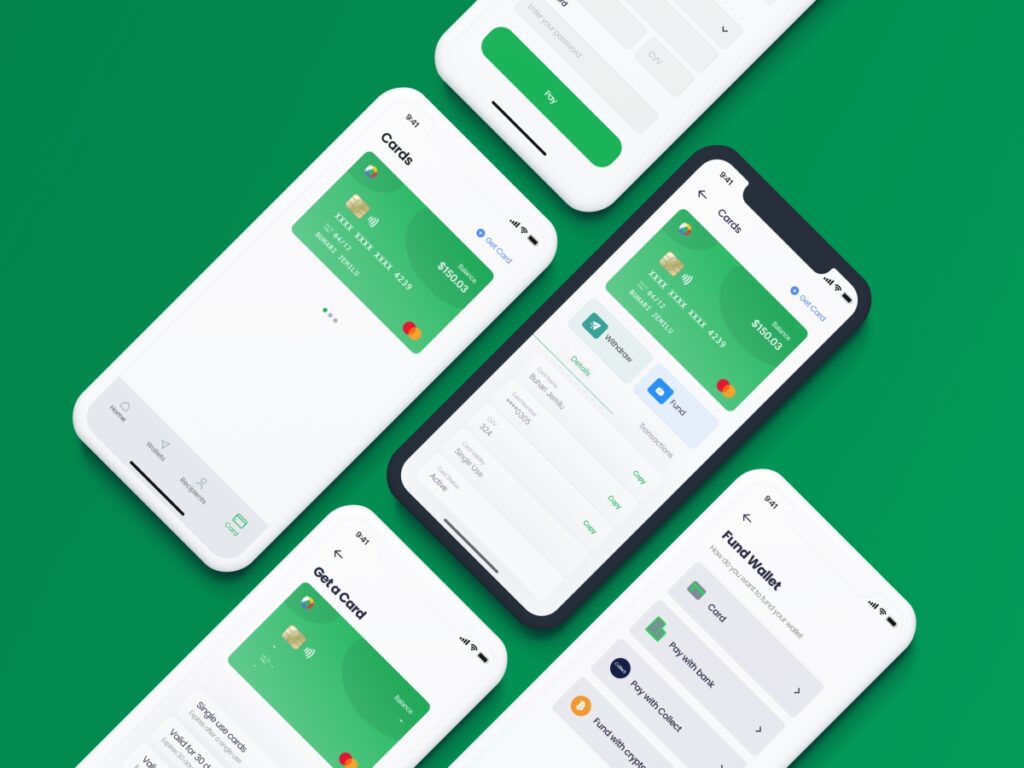

Changera App

Changera app lets you send and receive money internationally, buy airtime or data for family and friends, pay utility bills for your loved ones from anywhere in the world. With the Changera easy dollar card, you can spend more than $10,000 in a month. The beautiful part is that within the app you can use the virtual card to make all your online payments.

Recommended: How to add money to PayPal account from Changera card

What you can do through the Changera app

The Changera app gives you access to every feature you need when you are doing international money transfer, allowing you to:

- Send money to anyone abroad especially in Ghana, Nigeria, and Kenya

- Pay bills for your loved ones

- Make payment with an Easy Dollar Card without any restriction on the US dollars cap if you are in Nigeria

- Do airtime top up for your friends and family in many countries

- Use the virtual card to fund your PayPal account .

Unlock the power of money without limits with Changera, download the app from Google play store or App store on your mobile phone to start enjoying the best money transfer services without any delay from the comfort of your home or office.

Discussion about this post